FERS Retirement Computation - OPM

FERS Retirement Calculator - When You Can Begin Drawing FERS Annuity

The Best Strategy To Use For Federal Retirement Calculators - Federal Benefits Information

Refer to TSP's site for the Historical Annuity Rate Index elements. The non-TSP cost savings quantity that you went into might include savings from different sources such as your savings account(s), non-TSP mutual funds, and non-TSP retirement funds (personal sector 401-Ks, Person Retirement Accounts, etc.). Catch-up Contributions "Catch-up contributions" are extra tax-deferred worker contributions that staff members age 50 or older can make to the Thrift Saving Plan (TSP) beyond the maximum quantity they can contribute through regular contributions.

The maximum "catch-up contribution" in 2012 is $5,500. If A Good Read went into a legitimate catch-up contribution amount, this quantity will be included in the general TSP balance for purposes of calculating the approximated TSP annuity. Civil Service Retirement System (CSRS)Civil Service Retirement System. Workers under CSRS were generally very first hired prior to 1984.

Indicated on your SF 50 by a 1 in box 30 and the notation CSRS.CSRS-Offset, Staff members are covered by CSRS and have social security coverage since of a break in CSRS just protection greater than 1 year. Shown on your SF 50 (Notice of Worker Action) by a C in box 30 and the notation FICA and CSRS (Partial).

FERS and CSRS Plans

Rumored Buzz on Federal Retirement Calculators - Federal Benefits Information

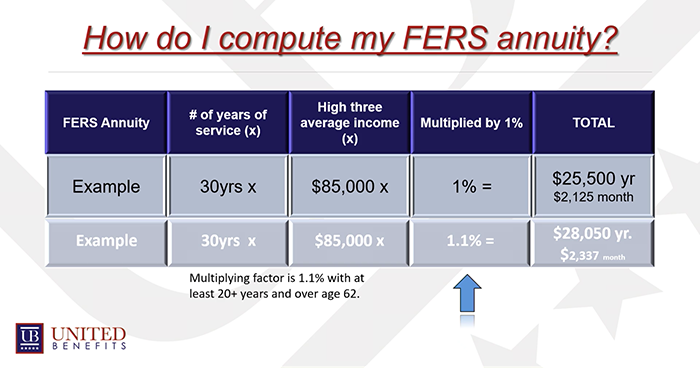

Present Dollars/ Today's Dollars, Estimated advantage amount, without future boosts in costs or profits. We use the inflation rate for converting to present year dollars. Current Wage, Although retirement annuity is based upon a person's high 3-year typical salary, for purposes of the Federal Ballpark E$ timate, enter your present annual wage.

FERS Retirement/Pension Calculator - Plan Your Federal Benefits

FERS Deposits, Non reduction service carried out prior to January 1, 1989 requires a deposit to be praiseworthy for the Basic Advantage portion of FERS and towards the retirement SCD. Non deduction service performed after December 31, 1988 is not reputable toward the Basic Benefit part of FERS and is not to be consisted of for the retirement SCD.

Federal Employees Retirement System (FERS)The Federal Employees Retirement System (FERS) was established by Public Law 99-335 in Chapter 84 of title 5, U.S. Code and reliable January 1, 1987. The majority of new Federal staff members worked with after December 31, 1983 are instantly covered by FERS. Particular other Federal employees not covered by FERS have the option to transfer into the strategy.